(June 2013) The second report from Mapping the Invisible Market, Growing Income, Growing Inclusion, proposes that massive income growth around the world over this decade will have a significant effect on the demand for and use of formal financial services.

Click on the boxes below for interactive data visualizations:

Global Movement Into the Vulnerable Class

Around the world, hundreds of millions of people are moving from extreme levels of poverty into income levels where they begin to have more income flexibility. This growth is especially noticeable among the bottom 40 percent of the global population, a group that has not been able to participate in formal financial services as much as the top 60 percent of the population. In fact, among the bottom 40 percent of the population in low and middle income economies, additional contributions to national income will total $5.8 trillion (cumulative). By 2020, the annual income of this group will be $2.7 trillion per year higher than in 2010.

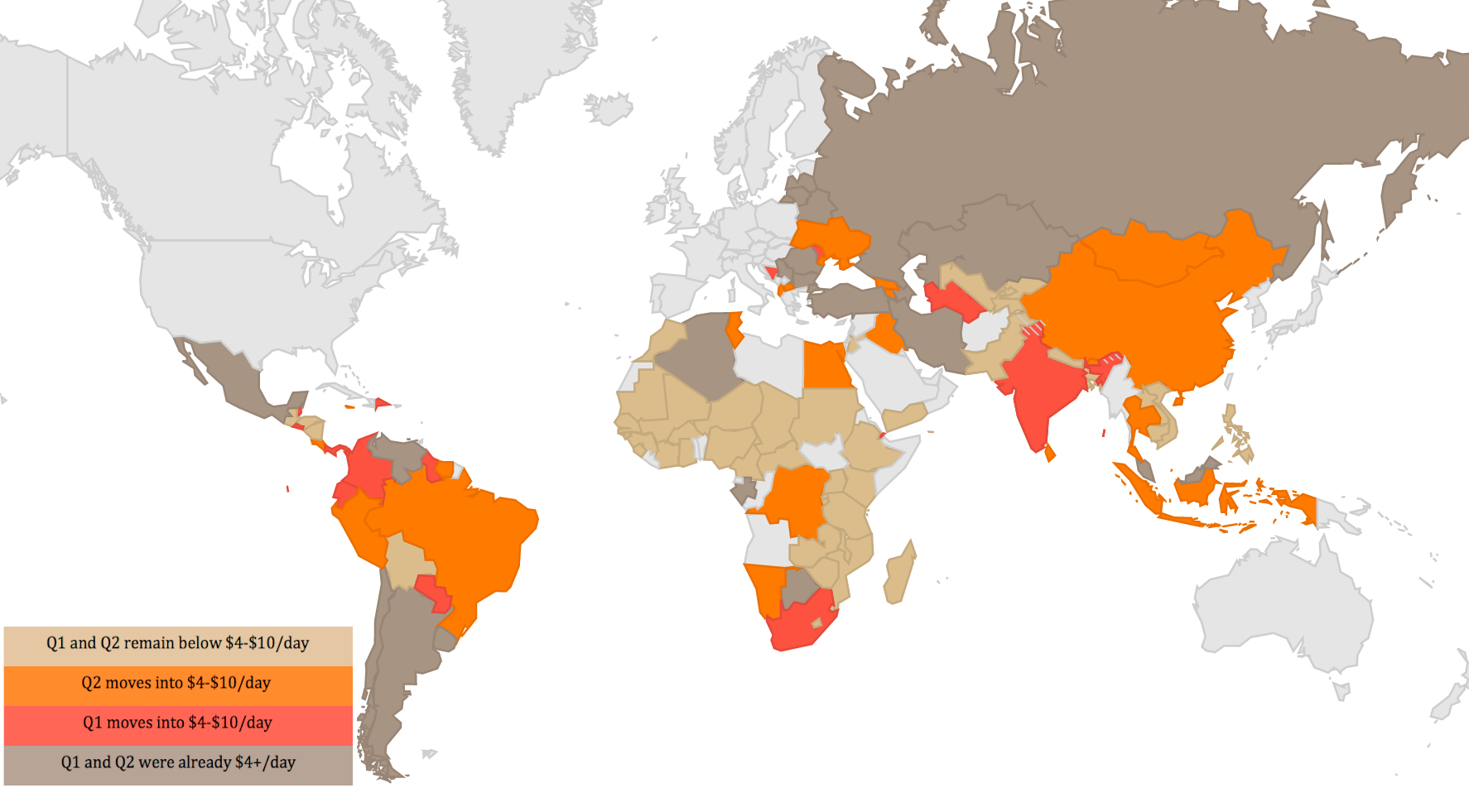

Over the course of this decade, many of the first and second economic quintiles of national populations will move into a new wealth category—not quite poor, and not quite middle-class—that has been called the “vulnerable class.” This vulnerable class is defined as having an average income of between $4 and $10 per day. Many of the world’s most populous countries are seeing this transition: China, India, Indonesia, Brazil, Egypt, Thailand, Iraq, Morocco, Argentina, Peru, Ukraine, South Africa, and others.

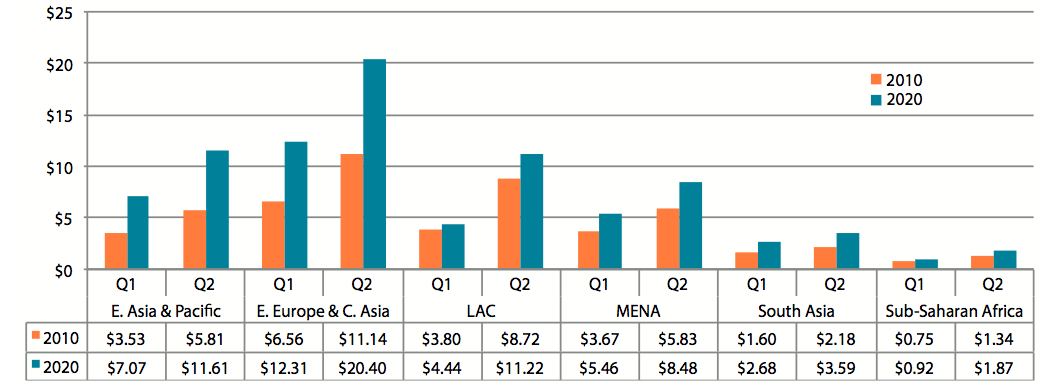

Growing Income Across Regions, 2010-2020

Over the course of the decade, incomes will rise in every quintile in every region. By the end of the decade, much of the world will be living on or above $4 to $10 per day, a level at which people have some disposable income beyond primary needs and at which they begin to shift their financial management to more formal services.

Effects on Financial Inclusion for Providers and Policymakers

With global income growth, financial management will likely shift to more formal services as people gradually “outgrow” their informal mechanisms. The likelihood of making this shift is dependent on a number of factors, however, including the level, source, and volatility of an individual’s income. Formality of employment makes a difference in this shift, as does trust, with people more readily transacting with institutions they trust and products they are comfortable using. For providers, success in meeting this demand is dependent on understanding the mechanisms behind the shift to formal financial services. If providers can offer appropriately tooled products, higher incomes at the base of the pyramid will translate into greater financial inclusion. There are many possible “on-ramp” products that introduce these customers to formal financial services, but the process of transition to a broader range of products is not yet well understood.

Policymakers have responsibility both to encourage growth, and to safeguard it. The most effective national strategies will allow for innovation, and will focus on protecting clients who are using formal financial services for the first time. Client education and protection are increasingly important, as consumers who have been previously excluded from financial services are especially vulnerable to fraud, scams, and over-indebtedness.

However, poverty persists globally, especially in Africa and South Asia, despite the global rise in income. Advances in technology and falling costs offer the chance to bring financial services to even poor and remote populations. For these countries, there continues to be a need for financial inclusion players who are committed to providing services to those at the bottom of the pyramid, even if it means not being able to cover costs.

Scroll through and download Growing Income, Growing Inclusion by Elisabeth Rhyne and Sonja Kelly:

FI2020's Mapping the Invisible Market is generously supported by MasterCard Worldwide.